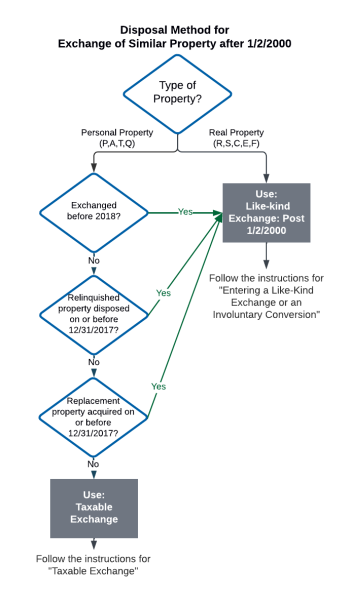

Like-Kind Exchange: Post 1/2/2000

Use the Like-Kind Exchange: Post 1/2/2000 disposal method for real property like-kind exchanges that occur after 1/2/2000 and for personal and amortizable property like-kind exchanges occurring prior to January 2018. For more information see Like-Kind Exchanges and Involuntary Conversions Overview.

For exchanges occurring in 2018 and later, updated IRS guidelines limit Like-Kind Exchange treatment for tax purposes to real property (types R, S, C, E, F) unless:

(1) the relinquished property was disposed on or before December 31, 2017; or

(2) the replacement property was acquired on or before December 31, 2017.

For instructions on how to enter a Like-Kind Exchange see Entering a Like-Kind Exchange or an Involuntary Conversion.

For more information on personal and amortizable property exchanged after 2017, see Taxable Exchange.

For real property, the system defaults the option to recognize gain to No for all books, regardless of the disposal date.

The Internal and user-defined books default to No for all disposal dates and property types. No is generally appropriate for financial accounting under U.S. GAAP when the exchange results in a gain, no boot is received, and book-value accounting is required for the transaction due to the nature of the exchange (as opposed to fair-value accounting). The value can be changed to Yes or Deferred, if needed.

For treatment of the asset received in the exchange, see Entering a Like-Kind Exchange or an Involuntary Conversion for instructions.